Heaptalk, Jakarta — Indonesia-based research company Populix found that 41% of respondents said they had used online loan services or fintech P2P lending, which was dominated by men and the millennial generation on the island of Java.

These findings are based on the results of a survey entitled ‘Unveiling Indonesia’s Financial Evolution: Fintech Lending and Paylater Adoption’ which was conducted online on September 15-18, 2023. A total of 1,017 respondents consisted of women and men aged 17-55 years in Indonesia.

“Our survey shows that two-thirds of respondents have used online loan services. The ease of borrowing funds offered by the online loan apps can become an alternative source of financing, especially as business capital for MSME players,” said Co-founder and CEO of Populix Timothy Astandu.

However, the survey results also revealed that 49% of respondents admitted that they did not understand the applicable regulations regarding fintech lending activities. According to Timothy, the widespread adoption of online loans which is not accompanied by an understanding of these regulations is a critical alarm for stakeholders. Without adequate financial literacy, people are at risk of being trapped in illegal applications and bad credit.

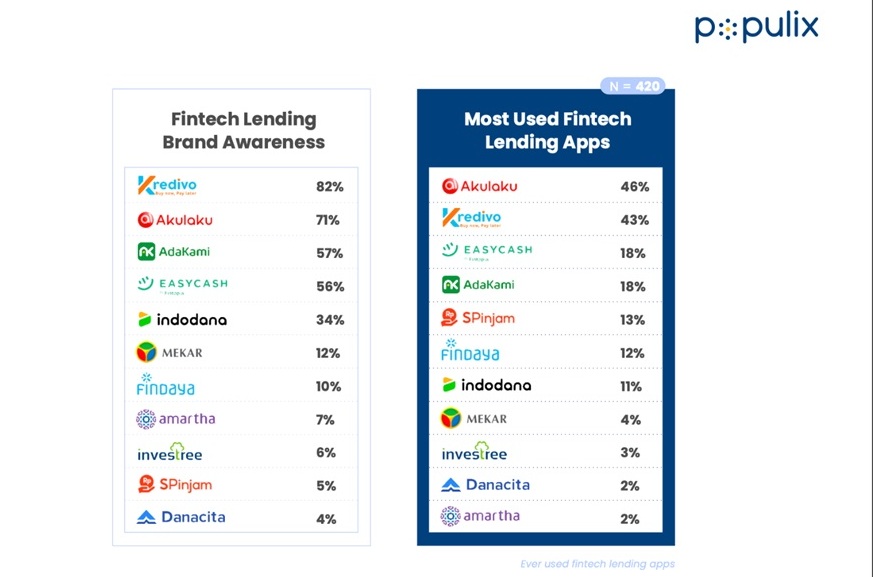

This report showed that 66% of respondents used online loan services less than once a month with the majority (70%) only relying on one application. The top four fintech lending apps accessed by respondents were Akulaku (46%), Kredivo (43%), EasyCash (18%), and AdaKami (18%). Meanwhile, SPinjam was in the 5th most used application position, with 13% of respondents saying they most often use this app to apply for loans.

Financing household needs and business capital

Regarding nominal loans, 65% of respondents had fintech lending installments of less than Rp1 million per month and the maximum amount of bills they had at one time was Rp3 million. This shows that Indonesians tend to be careful in making loans, especially due to budget constraints and to reduce risk.

In general, loan funds were mostly used to finance household needs (51%), business capital (41%), purchase work support equipment (25%), education funds (23%), lifestyle and entertainment (22%), as well as health (13%).

In choosing a fintech P2P lending application, respondents considered the following things: speed of disbursement of funds (77%), OJK permission (72%), easy registration process (52%), and low interest (50%). This preference emphasizes the importance of loan provider apps prioritizing accessibility, speed, and obtaining government permission.

In January 2023, the Indonesian Financial Services Authority (OJK) recorded that there were 102 legal online loan services licensed by the institution. As of June 2023, total fintech P2P lending financing had reached Rp52.7 billion, growing 18.86% (yoy). Currently, fintech P2P lending is a major contributor to the Indonesian economy with growth exceeding the financial sector industry in general.