Heaptalk, Jakarta — Jenius has officially introduced its supplementary credit card, s-Card, designed to simplify cash flow management (05/08). This card can be issued to family members, close acquaintances, or even oneself to help with budgeting for specific needs.

Like the primary credit card (d-Card), the s-Card is available as a physical card for offline transactions and a virtual card within the Jenius app for online transactions. Users can apply for up to five supplementary credit cards directly from the app. These cards can be issued to fellow Jenius users or even those not yet Jenius customers.

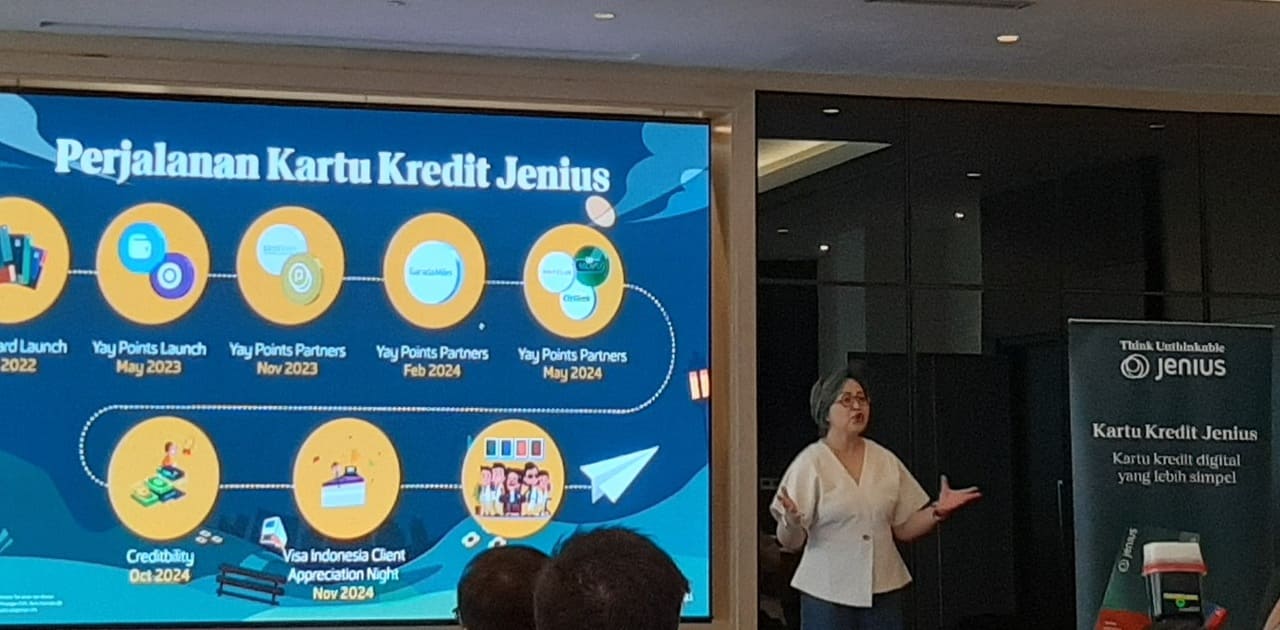

Anita Ekasari, Jenius Business Stream Head at SMBC Indonesia, stated that the card is designed to help users manage cash flow and accumulate Yay Points more efficiently. “Jenius’s spirit is to always co-create with our customers. We’ve listened to their needs—41% of users want a supplementary credit card to provide family or loved ones with a convenient and reliable payment method, 33% aim to earn points faster, and 26% seek full control and monitoring over the supplementary card,” Anita explained in Central Jakarta (05/08).

Monitoring transactions in real time

To apply for an supplementary credit card, the primary cardholder must enter the recipient’s $Cashtag if they are already a Jenius user. For non-Jenius users, the primary cardholder must upload a copy of the recipient’s ID card and fill in the card delivery address. Primary cardholders can monitor s-Card transactions in real time via app notifications.

They can also easily manage the issued cards through the app, including: Changing the PIN, setting individual spending limits per card, adjusting per-transaction spending limits, enabling/disabling ATM cash withdrawals, toggling online transaction permissions, managing overseas transaction settings, temporarily or permanently blocking the card, and closing the card.

As a d-Card holder, users can also easily track each s-Card’s transaction history from the Transactions menu. Additionally, primary cardholders will receive real-time notifications (via app or email) for every supplementary card transaction, enhancing security against unauthorized transactions.

Managing supplementary cards from the app

On the other hand, s-Card holders can also manage their supplementary cards directly from the app, including: Activating the card, choosing a card design, filling in the delivery address, viewing transaction history, checking remaining credit limit, blocking/unblocking the card, and viewing card details. For online transactions, an OTP (one-time password) will be sent directly to the supplementary cardholder’s smartphone.

Indra Priawan, a Jenius user and entrepreneur, shared his experience using this supplementary credit card. According to him, managing household expenses and travel requires solid financial planning, and one way he does this is through credit cards. “With Jenius, requesting, activating, and managing the s-Card is incredibly easy—everything can be done right from the app. I gave one s-Card to my wife for household budgeting and travel expenses. This allocation helps us accumulate Yay Points faster, which we can redeem at merchants we frequently use,” Indra concluded.