SINGAPORE, Nov. 16, 2023 – Sustainability is garnering significant investor interest in ASEAN despite uncertain macroeconomic conditions in 2023, with Green Financial Technology (FinTech) firms bringing forth innovative solutions to help businesses and governments address challenges and opportunities of going green. This insight is part of the FinTech in ASEAN 2023: Seeding the Green Transition report, jointly launched by UOB, PwC Singapore and the Singapore FinTech Association (SFA) today.

Singapore retained its podium position within the region, securing US$747 million FinTech funding, or 59 per cent of total funding in ASEAN. Though this was a decrease of over 180 per cent year-on-year, Singapore still attracted 51 deals, the highest in the region. The deals were distributed across eight FinTech categories, the widest range in the region.

Ms Janet Young, Managing Director and Group Head, Channels & Digitalisation and Strategic Communications & Brand, UOB, said, “Despite markets and investors becoming more cautious this year, bright spots remain with certain FinTech segments such as early-stage and Green FinTechs showing resilience. As a long-term supporter of FinTechs, UOB is committed to journeying through this uncertain climate with the broader FinTech and Green Tech ecosystem by leveraging on our regional network to seize opportunities and drive innovation. Together we can forge a sustainable future and create impact for our stakeholders in ASEAN.”

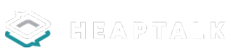

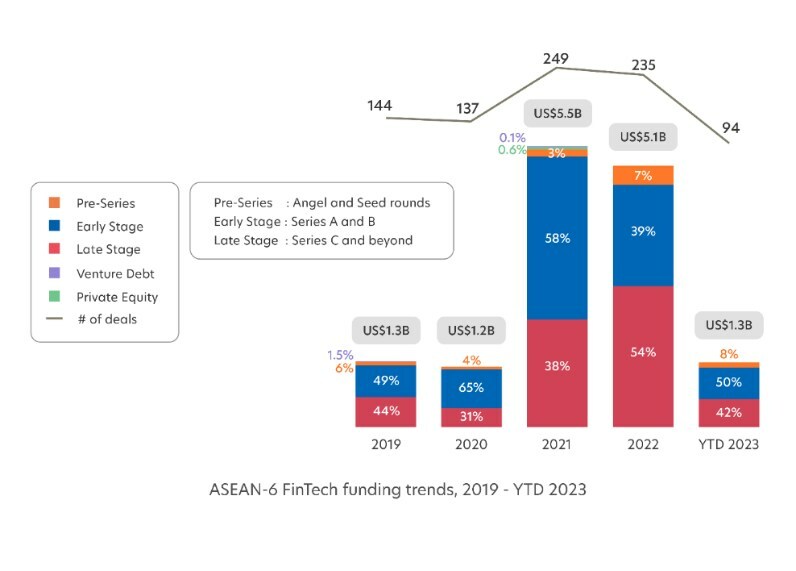

This year, Singapore and other ASEAN FinTech firms continue to face the same funding winter seen globally. FinTech investments in the six biggest ASEAN economies[1] came to US$1.3 billion in the first nine months of this year (9M23), a sharp decrease of around 70 per cent compared with the same period in 2022.

Since third quarter 2022, funding for ASEAN FinTechs has been declining as investors held back after a huge funding surge post-pandemic. Of the total global FinTech funding in 9M23, the amount attributed to ASEAN FinTechs dropped by two percentage points to three per cent, the region’s lowest funding amount since 2020. Number of deals also decreased by more than half to 94, with average deal size reduced to US$13.5 million from US$23.3 million.

Shadab Taiyabi, President, Singapore FinTech Association, said, “While the landscape for FinTech funding across the region has certainly been trickier to navigate, it is good to see that Singapore retains its position as the region’s most vibrant destination, attracting the highest number of deals. It is heartening to us that investors recognise the quality of Singapore’s firms and their ideas, and we are confident that despite lower levels of funding, Singapore’s FinTech star will continue to shine brightly not just across the region, but worldwide.”

Wong Wanyi, FinTech Leader, PwC Singapore, said, “Despite ongoing macroeconomic concerns, FinTech is integrated in the day-to-day operations and lives of many, and it is here to stay. With the climate challenge requiring stronger concerted effort across all industries and governments, Green FinTechs and sustainable finance are spaces where Singapore can take the lead in establishing trust and helping to move the needle on one of the major challenges facing our time. In more than one way, FinTech players have good reasons to persevere and get ready to seize future uptrends.”

‘Green’ and ‘Young’ shoots in ASEAN drew greatest attention

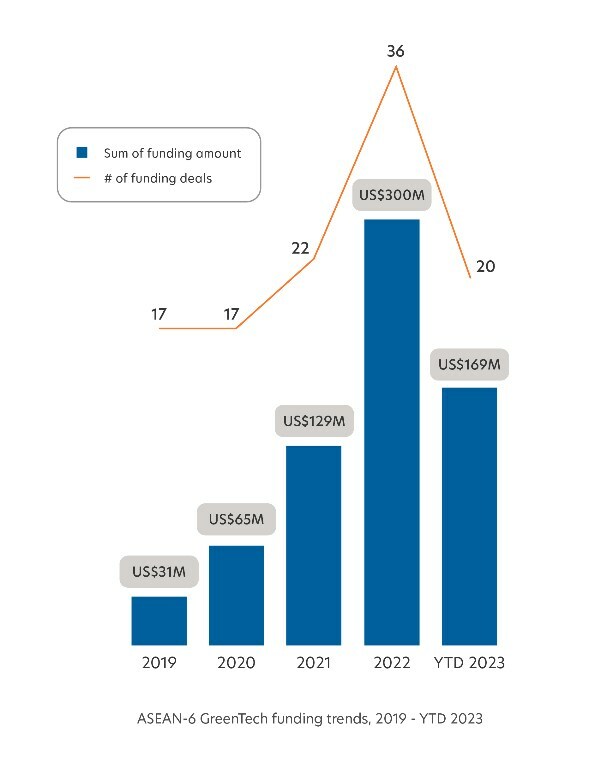

Sustainability is one area that is attracting significant investor interest in ASEAN and globally. ASEAN’s green technology sector received US$169 million in funding in 9M23, and investments for this sector has shown an upward trend in the past five years.

Interests in sustainability solutions grew due to increasing climate-related regulations, government support and rising awareness of environmental issues. The Asia Pacific region is one of the most vulnerable to climate-related impact[2] and many governments in ASEAN have begun exploring green financing initiatives and regulations to support the region’s energy transition efforts. Businesses surveyed by UOB also echoed the importance of going green and its benefits[3]. Investors have projected carbon emissions management and reporting, as well as green financing solutions to be key growth areas for this sector.

Besides Green FinTechs, early-stage firms[4] in ASEAN have also managed to seize market opportunities with new start-up ideas and smaller capital outlays. These firms make up six of the top 10 funded FinTech firms in ASEAN and one of the only three deals above US$100 million in 9M23. They also secured half of the total funding investments in ASEAN, a significant increase from 39 per cent last year. The top 10 funded ASEAN FinTech firms received an average funding amount of US$94 million in 9M23, a fall of close to 60 per cent compared with 2022.

Singapore and Indonesia lead FinTech investment in ASEAN

Among the six ASEAN countries, Singapore and Indonesia accounted for more than 86 per cent of total FinTech funding and 80 per cent of funding deals in ASEAN. Indonesia contributed to 27 per cent of funding and 16 per cent of the total deals worth US$340 million, largely driven by one mega deal. Vietnam and Malaysia experienced a modest increase in their share of number of deals by the third quarter in 2023, with a six percentage point and four percentage point growth respectively.

With a volatile market and uncertain macroeconomic outlook, the number of new FinTech firms set up across ASEAN has dropped to 95 companies this year, falling more than 75 per cent from last year. Investors highlighted that the observed decline in FinTech funding predominantly aligns with the broader downtrend in the technology sector, but looking ahead, rapid advancement in artificial intelligence (AI) technology is a key emerging space that will propel the next generation of FinTech innovations.

The FinTech in ASEAN 2023: Seeding the Green Transition report was announced at Singapore FinTech Festival today. For the full report, please visit go.uob.com/fintech2023.