Heaptalk, Jakarta — Jenius, a digital banking product from SMBC Indonesia, has launched two new features, Cash Cow and Bayar & Nabung (means pay and save) (03/20). The launch coincides with the rollout of their Ramadan program titled #JagainRamadan bareng Jenius, which means Safeguarding Ramadan with Jenius.

By the launch of these new features, Jenius to address the needs of an increasingly dynamic, savvy, and digitally integrated society, balancing daily transaction needs with growing savings. In recent years, Indonesians’ financial behavior has undergone significant changes. Driven by technological adoption and a shift toward more practical, digital lifestyles, digital transactions have grown rapidly.

Febri Rusli, Digital Banking Product & Innovation Head at SMBC Indonesia, explained that the new features were developed in response to customer pain points, particularly the difficulty of saving despite Jenius offering various savings features such as Flexi Saver and Dream Saver. Additionally, savings accounts offering optimal interest rates typically require a minimum balance and specific tenures, such as a 6% interest rate for a minimum deposit of Rp50 million.

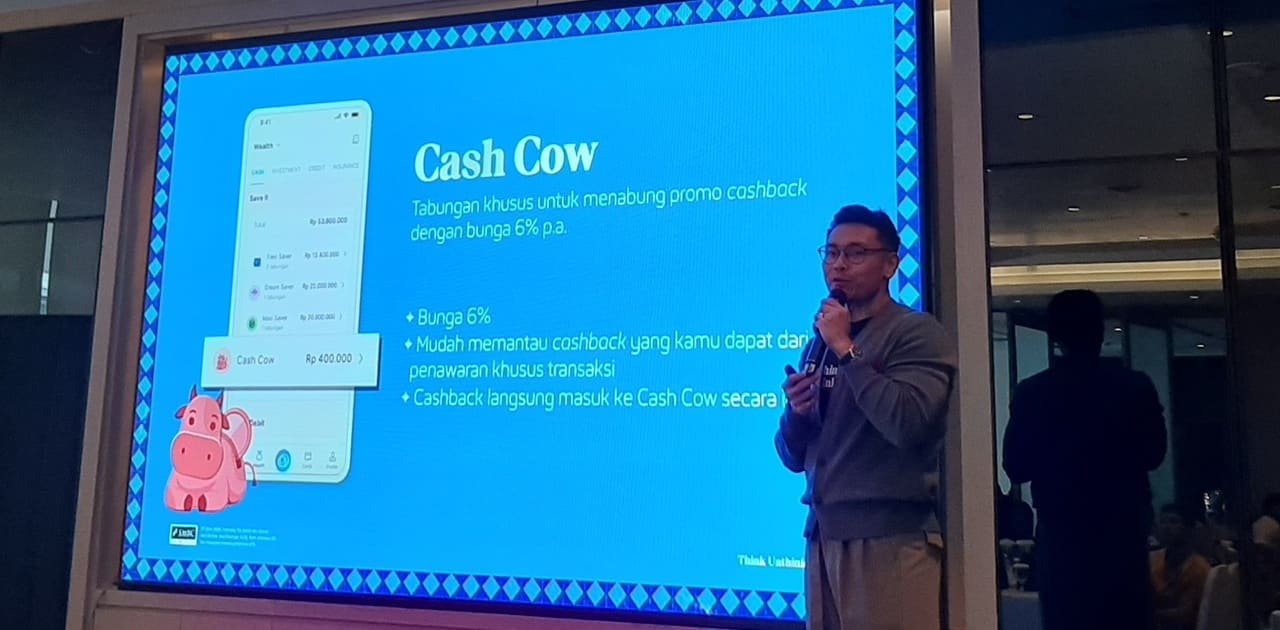

“We then innovated to ensure that even those who spend regularly can save with competitive interest rates through Jenius. This led us to introduce Cash Cow, a uniquely named feature offering a high 6% interest rate with no minimum balance or additional terms and conditions,” Febri said during the Jenius feature launch event at Pullman Thamrin Hotel, Central Jakarta (03/20).

Offering a competitive interest rate of 6%

Febri explained that Cash Cow is a positive term often used in business portfolios, referring to a reliable asset that generates consistent growth. This feature is a savings account with a competitive interest rate of 6% per annum, which can be funded through cashback earned from favorite merchant promotions and cashback programs within the Jenius app, such as e-Wallet top-ups or monthly s-Card fee cashback. This digital banking product offers a promotional interest rate of 9% per annum for Cash Cow, valid from March 19 to August 31, 2025.

Additionally, Cash Cow can be funded through the newly introduced Bayar & Nabung (Pay & Save) feature. This new capability allows users to automatically set aside a portion of their transaction amount into Cash Cow whenever they use QRIS or pay bills using their active balance, with a maximum limit of Rp250,000 per transaction. This facilitates users to save consistently with optimal interest rates without requiring a minimum deposit or tenure.

As part of the #JagainRamadan bareng Jenius program, users can take advantage of various attractive promotions, including breaking the fast at Sushi Tei and Katsukita, shopping for Ramadan and Eid preparations at Aeon Supermarket and GrandLucky Superstore, and purchasing tickets for homecoming trips and holidays on platforms like Tiket.com, Traveloka, and Aviatour. Jenius users can enjoy cashback or discounts of up to 50%, depending on their Green Club level.

Specifically for Ramadan, Jenius collaborates with Rumah Zakat, Baznas, and Dompet Dhuafa through the Ekstra Donasi (Extra Donation) program. For every donation of at least Rp150,000 made by Jenius users, the digital banking app will add an extra donation of Rp25,000. This program runs from March 5 to April 30, 2025. It is applicable for payments made via Jenius Pay on the websites of Rumah Zakat, Baznas, and Dompet Dhuafa, as well as through the Rumah Zakat app or the Bayar Tagihan (Pay Bills) menu in the Jenius app.