Heaptalk, Jakarta — Citi Indonesia posted a net profit of Rp645 billion, approximately US$39.7 million (US$1 equals Rp16,244), in the first quarter of 2025. This achievement was supported by an 11% year-on-year (yoy) increase in net interest income and a stable low-cost fund ratio of 74%.

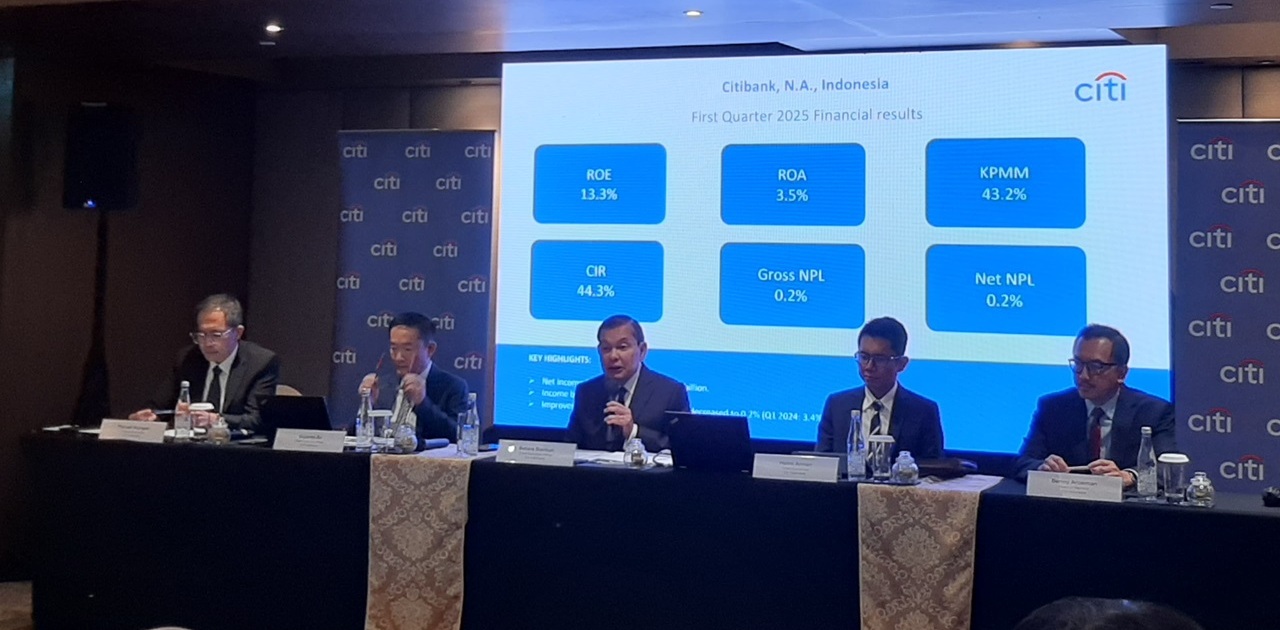

The bank’s return on equity (ROE) stood at 13.3%, while its return on assets (ROA) reached 3.5%. Asset quality improved, with the gross non-performing loan (NPL) ratio declining to 0.2% from 3.4% in 2024.

The liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) remained strong at 340% and 159%, respectively, well above regulatory minimums. The capital adequacy ratio (CAR) was reported at 43.2%, up from 39.6% the previous year.

Batara Sianturi, CEO of Citi Indonesia, stated that amid global economic uncertainty driven by geopolitical tensions and market volatility, Citi’s international network remains a competitive advantage, resulting in the net profit in Q1 2025. He expressed optimism that the company is strategically positioned to support cross-border clients, particularly as they adapt to the new global landscape.

“We will continue to support our clients’ financial growth and the resilience of Indonesia’s banking sector through strategic initiatives and our commitment to providing comprehensive financial services and solutions via our interconnected business in Indonesia,” Batara said during a press conference in Central Jakarta (05/26).

Streamlining payment initiation

In its banking division, Citi serves local corporate clients, multinational companies, financial institutions, and the public sector. Despite challenging external conditions, the business recorded solid revenue growth in Q1. The treasury and trade solutions (TTS) business saw positive year-on-year growth in Q1, driven by a 14% increase in CASA balances and a 7% rise in commercial card usage. Additionally, TTS completed the migration of CitiDirect from offline to online authorization.

Batara added, “As part of this initiative, Citi has streamlined payment initiation, enhanced payment management for approval and tracking, improved reporting and access to information, and enabled self-service liquidity structure management—all to deliver the best digital banking experience for our clients.”

The investor services business actively contributed to developing Indonesia’s capital markets and supported regulatory digitalization efforts. Meanwhile, the markets division served clients in the foreign exchange (FX) and fixed-income segments. Citi Indonesia provides FX services to corporate and institutional clients through CitiFX Gateway/SFTP, CitiFX Pulse, CitiDirect, and CitiConnect. It aims to offer fully automated and integrated FX and payment solutions that ensure efficient execution amid evolving market conditions.